“The arrival of multinationals is revolutionising the entire office market in Malaga”

Aranzazu García

Offices. Leasingaranzazu.garcia@savills.es

Offices. Leasingaranzazu.garcia@savills.es

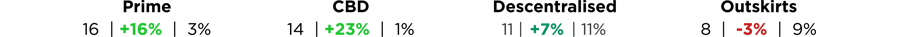

Intense activity by multinationals, mainly in the technology sector, is energising this segment considerably. The evolution of procurement in the last year has led to a decrease in the vacancy rate, which has returned to around 5%, recovering pre-pandemic average values, while in the CBD and Prime areas, availability is minimal. The impetus of these top-level companies, which find in Malaga quality of life for their employees and a new tech ecosystem, together with more competitive rents than other places such as Madrid or Barcelona, has acted as a catalyst, driving the development of new areas and the growth of the office stock in the medium term. For the time being, however, the shortage of quality space complicates new contracts in many cases, slowing down time frames. The flex space format is working as an alternative, favouring the arrival of new companies. Operations involving a change of use in spaces likely to house workspaces are also continuing. This combination of factors has led to increased interest by real estate investors in taking positions in existing assets and in the development of new projects. Profitability ranges and the prospects for attracting demand provided by the city's positioning confirm the market's potential. The city has a pipeline of more than 35,000 square metres of new floor space for 2024-2025 with upgraded quality standards. This will help to ease the current pressure between supply and demand and consolidate the market in Malaga, although new developments will still be necessary to ensure the city's economic and business growth. This flurry of activity has pushed average rents in the city up 16%, with increases reaching 23% in some areas such as CBD and Decentralised. However, compared to larger markets, prices remain very competitive, with average rents below those of major European cities.